Single Audits – When Do You Need One

Making Sense of the Employee Retention Tax Credit

PPP Loan Updates and Reminders

The American Rescue Plan: Restaurant Revitalization Fund

Latest Stimulus Bill: What’s in it and What it Means for You

Second-Draw PPP Loans Affiliation Rules

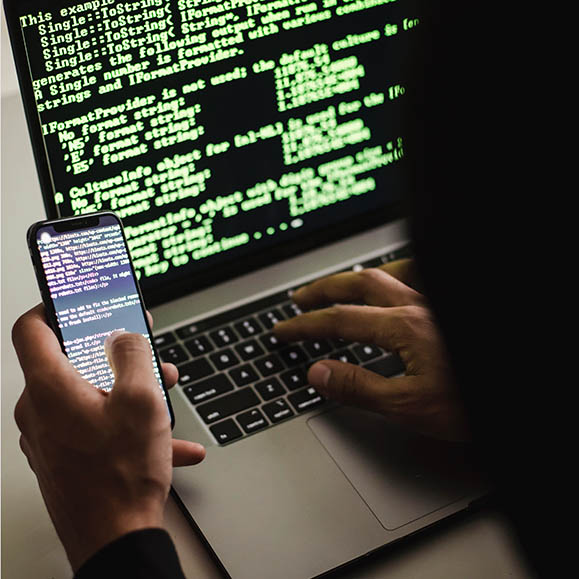

Small Businesses Should Be on Alert for Loan Application Scams

Heightened Identity Theft Involving Unemployment Benefits

Important Tax Credit Updates Under Latest COVID-19 Relief Bill