What is Accounting Fraud and What are the Different Types?

Many individuals want to know, what exactly is accounting fraud? There are three different types of common accounting fraud:

- Misappropriation of Assets: For example, stealing inventory or cash. This is the most common type of accounting fraud.

- Bribery and Corruption: This means giving or receiving an unearned reward to influence someone’s behavior or unlawful behavior to gain an advantage.

- Financial Statement Fraud: This can include overstating revenues or understating expenses.

According to the Association of Certified Fraud Examiner’s (ACFE) 2018 Report to the Nation, 42% of companies that have fallen victim to fraud are privately held. Based on the number of reported cases, the construction industry is listed as one of the top 10 most likely industries to experience fraud with majority of cases being related to corruption and billing fraud.

Generally, the more victims lose, the less they are likely to recover. Over half of victims who seek to recover losses from fraudsters will recover nothing. Less than a third of victims will recover a portion of their loss leaving a small portion of fraud victims able to recover all of their losses.

Taking a deeper dive into victim companies with less than 100 employees; when defrauded, these companies experienced a median loss of over $200,000. Of these cases, fraudsters were able to defraud the company by taking advantage of the lack of internal controls (42%), being provided unauthorized information (29%) or the owner or executives themselves part-taking in the fraudulent acts (29%). The most common types of frauds perpetrated included the following:

- Corruption (32%)

- Billing fraud (29%)

- Check tampering (22%)

- Expense reimbursement (21%)

As you can see there are many different types of accounting fraud and all can be done at different levels throughout the company – particularly corruption and billing fraud for companies within the construction sector.

What Causes Accounting Fraud?

The two main principles related to accounting fraud:

- The Fraud Triangle: Pressure, opportunity, and rationalization.

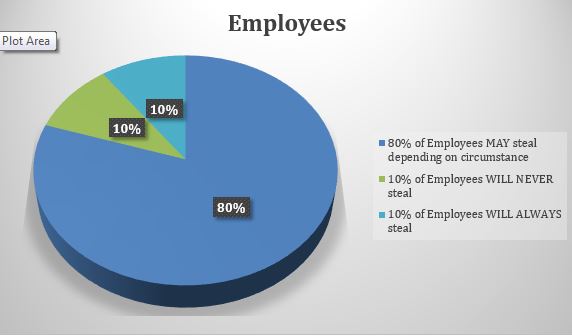

2. 10-10-80 Rule: 10% of employees will never steal, 10% of employees will always steal and 80% of employees will go either way depending on circumstances. Every circumstance and opportunity is different – and no company is immune.

3. Employees:

How Can You Prevent Fraud?

At Corrigan Krause we encourage companies to take a proactive approach to deter fraud. Ultimately, being proactive will be less costly and devastating to the bottom line and moral of the company. We strongly suggest companies implement anti-fraud controls. Although there is no guarantee the controls will deter fraud, it will help detect fraud earlier and shorten the duration of the fraud. Some examples include:

- Background checks of key employees

- Surprise audits

- Internal audit department

- Whistleblower hotline

- External audit of internal controls over financial reporting

- Job rotation/mandatory vacation

- Anti-fraud policy and fraud training

Watch closely! There are also many different behaviors that can help you detect fraud in the workplace. These behaviors can include:

- Living beyond means

- Financial difficulties

- Unusually close association with vendor customers

- Unwillingness to share duties

- Divorce/Family issues

What to do When You’ve Detected Fraud at Your Company

- Safeguard your evidence. Do not start examining the evidence on your own. Evidence can be easily tampered with even if this wasn’t your intention.

- Gather a team. This team will help you gather and analyze data.

- If it is internal, deal with the suspected employee. Restrict this employee from all company documents and data.

- Notify your insurance provider. This will help to prevent you from loosing coverage.

- File proof of loss. Document any losses and make sure they are properly recorded.

How We Can Help You Prevent Fraud at Your Company

As your CPA, there are many different ways we can assist you in preventing fraud from occurring at your Company. Here are a few services we provide:

- Anti-fraud services – review and strengthen internal controls & mechanisms to deter/prevent/detect fraud should it occur

- Perform surprise audits of key employees

- Recommend hotline services for whistleblowers

- Train employees and management on fraud, prevention and detection

Fraud is a popular topic currently because no company is spared from the risk. With the advances in technology there are better mechanisms to catch fraud but there are also more opportunities for individuals to commit fraud and cyber crimes. Contact a professional at Corrigan Krause for any other questions regarding how to protect your company from fraud.