As a business owner, implementing a retirement plan for your employees can be a crucial part of retaining your talent. Before jumping into a retirement plan or deciding it’s too expensive to undertake, take time to learn about your options and find the right fit for your team. There are more options out there, especially for small businesses, than you might think.

Why is it important to have a retirement plan for your employees?

A competitive benefits plan that includes retirement savings can attract and retain valuable employees, reducing new employee training costs. When employees feel like they are important to their business, it can create a healthy workplace culture and generally the employees tend to perform well for the company. You can read more about how to retain employees here.

In addition to helping to retain your top talent, establishing an employee retirement plan can also be beneficial to your business tax-wise. Employer contributions to an employee benefit plan are generally tax-deductible which allows assets to grow tax-free. The IRS also offers tax credits for starting a retirement plan to help businesses reduce costs.

What retirement plan is right for my business?

With a wide range of retirement plans available, it’s a good idea to connect with retirement plan and tax professionals when you’re choosing a plan. Working with professionals, like the ones at Corrigan Krause, can help ensure you are establishing the best plan for you and your employees.

What are the different retirement plan options?

Let’s get into the specific types of employee retirement plans:

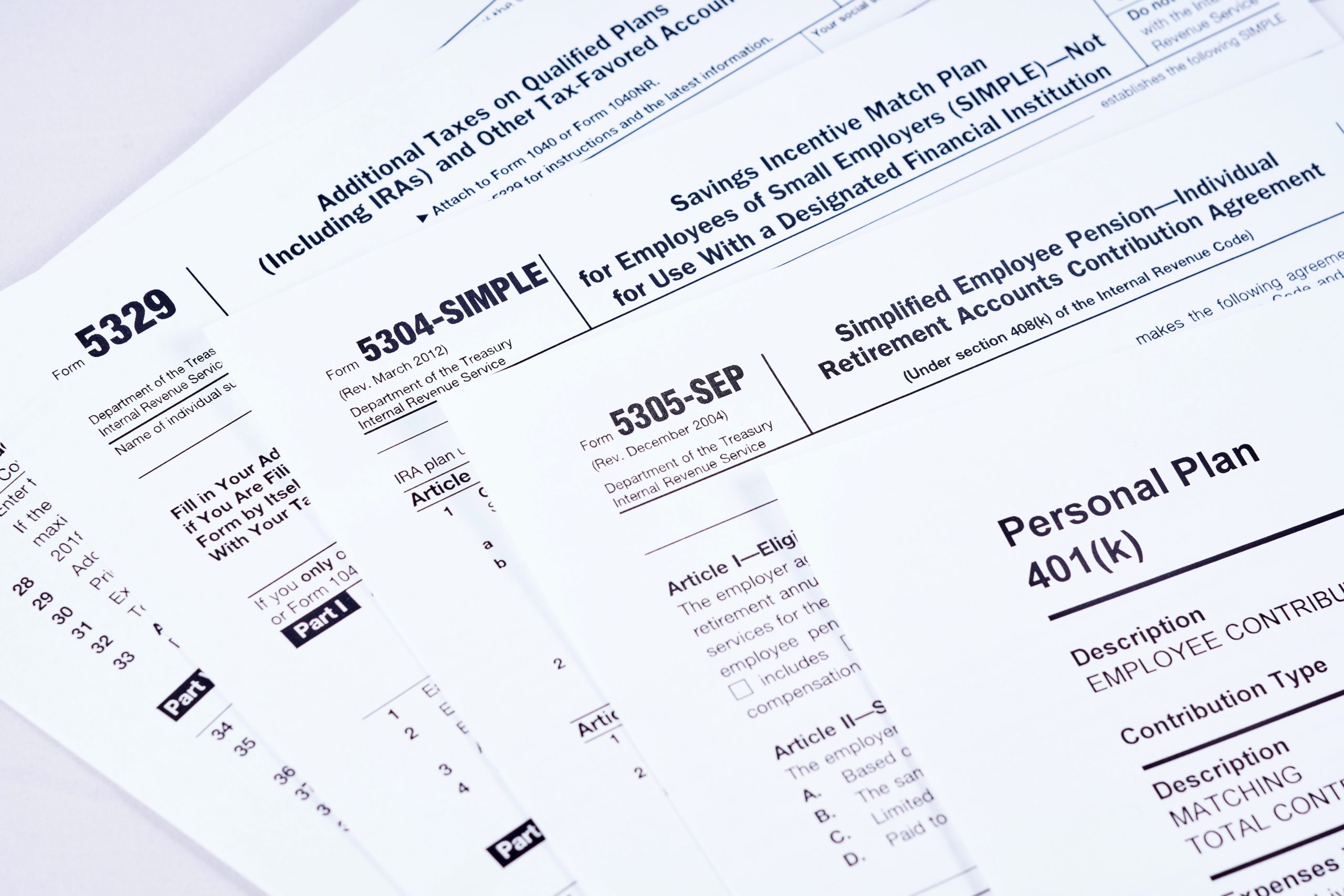

401(k) Plans

A 401(k) plan is the most common employer-sponsored retirement plan, however it is only available to for-profit companies. A 401(k) is a defined contribution account, meaning the employee pays in a certain amount from their paycheck every month into the account. The contributions can be pre-tax or post-tax (Roth). As a business owner, you have the option of matching a certain percentage of your employees’ contributions. Offering contribution matches can be an important piece of retaining your employees as it can improve employee morale and attract talent.

Depending on the size of your business, a safe harbor 401(k) may make sense. A safe harbor 401(k) is a traditional 401(k) plan that avoids annual IRS nondiscrimination testing. This is typically used by small businesses to bypass costly plan testing and provide the owners with higher contribution levels.

SIMPLE IRA Plans (Savings Incentive Match Plans for Employees)

A SIMPLE IRA is only available to small businesses with 100 employees or less. This plan has no start-up or operating costs, but must be the only retirement plan offered by your business. As an employer, you can choose between a matching contribution of up to 3% of total employee compensation or a non-elective contribution of 2% of eligible employees’ compensation. Your employees may also elect to contribute to their plan and benefit from deferring tax until withdrawals.

SEP Plans (Simplified Employee Pension)

A SEP plan is a simplified way for employers to contribute to their employees’ retirement funds. The employer contributes directly to an Individual Retirement Account (IRA) in their employee’s name. You may utilize a SEP plan in conjunction with another retirement plan.

Defined Benefit Plans

A defined benefit plan account is different as the ending balance of the account is set instead of the contribution balance. The benefit amount is calculated based on age, salary, and length of employment. Employers generally receive tax deductions based on their contribution. Because there is usually a period of time from the opening of the account and when the funds are vested, employees tend to stay with their employer as they wait to vest and earn their benefits. However, these plans are very costly to maintain, requiring an actuary and other testing.

Profit Sharing Plans

Profit sharing plans are funded by discretionary employer contributions that share the profits of a company with employees. Profit sharing can be a good option for your business if you want to be flexible and only contribute to the plan on an ad hoc basis and it can also be offered in conjunction with a 401(k) plan.. You decide when and how much to contribute to your employees’ plans. Profit sharing plans can help motivate employees to work for the greater good of company profits.

Payroll Deduction Plans

Payroll deduction plans allow employees to contribute money from their paychecks to an individual retirement account. As the employer, you set up the payroll deduction IRA program at a bank or financial institution and employees can choose to contribute. A major benefit of this plan is that it does not require plan documents and it’s simple. However, this plan does not create deductions for the business and may not motivate employees like other plans may.

How do I set up a retirement plan for my employees?

Once you chose the right retirement plan for your business, the next step is to establish and operate your plan. A retirement plan professional can help you through this process. We recommend starting with interviewing investment advisors, particularly ones that specialize in employer retirement plans. They can then assist you in choosing a platform to hold the assets.

These steps are good building blocks for kick-starting your retirement plan:

- Writing a plan

- Arranging a trust for the plan’s assets

- Notifying eligible employees of the new plan and its terms

- Creating a recordkeeping system

Beyond these, you want to look to the future and focus on maintaining the plan you worked so hard to build. Some ongoing steps to take may include making contributions, updating the plan in accordance with new laws, managing assets, providing information to employees who join the plan, and distributing their promised benefits.

Corrigan Krause can help

Implementing and maintaining a retirement plan can be a tall task for business owners but it can make a world of difference to your employees and your ability to hire top talent. Feel free to reach out at info@corrigankrause.com with inquiries and questions.